FinTech

B2B & B2C.

Product Overview

Project

LIn this project I was the project lead and worked with developers, advisors and the CEO. The task was to create a Investment Policy Statement (IPS) web app for Concert Wealth Management /OmniServices. The app was released online and has been used by Financial Advisors and their clients. The work presented here is done by me.

My Work

Direct and lead teams

Project management

Design sketches, visuals and prototypes

Creative briefs and documentation.

Problem

Concert provides tools for independent Financial Advisors. An Investment Policy Statement (IPS) is a questionnaire with general investment goals and objectives of a client. It describes the strategies that the portfolio manager should employ to meet these objectives.

An IPS lists the investor’s investment objectives, time horizon, risk/return profile and asset allocation. It establishes a systematic review process that enables the investor to stay focused on the long-term objectives, even as the market changes in the short term.

Project Development & Design

The team included the CEO, a developer and me.

Led daily scrum meetings with the developer in China.

Met regularly with the CEO for product reviews.

User research interviews with financial advisors and clients.

Defined and analyzed the IPS app requirements.

Created technical specs and included minimum and maximum deviation targets.

Analyzed comparable sites and apps like MorningStar, MoneyGuide Pro, Mint, etc

Reviewed UX and UI best practices, patterns, and guidelines with teams.

Defined and created wire-frames for the IPS architecture, flow, interactions, states, errors, etc.

Presented demos and updates to review flows, designs and interactions with teams.

User tested beta versions of the app and gathered information for revisions and iterations.

Created visuals for the IPS screens, asset libraries, state options, and interactions.

Collaborated with engineers to troubleshoot issues and solve problems.

Followed the process and road-map by going over the progress, requirements, and deadlines.

Final Flow

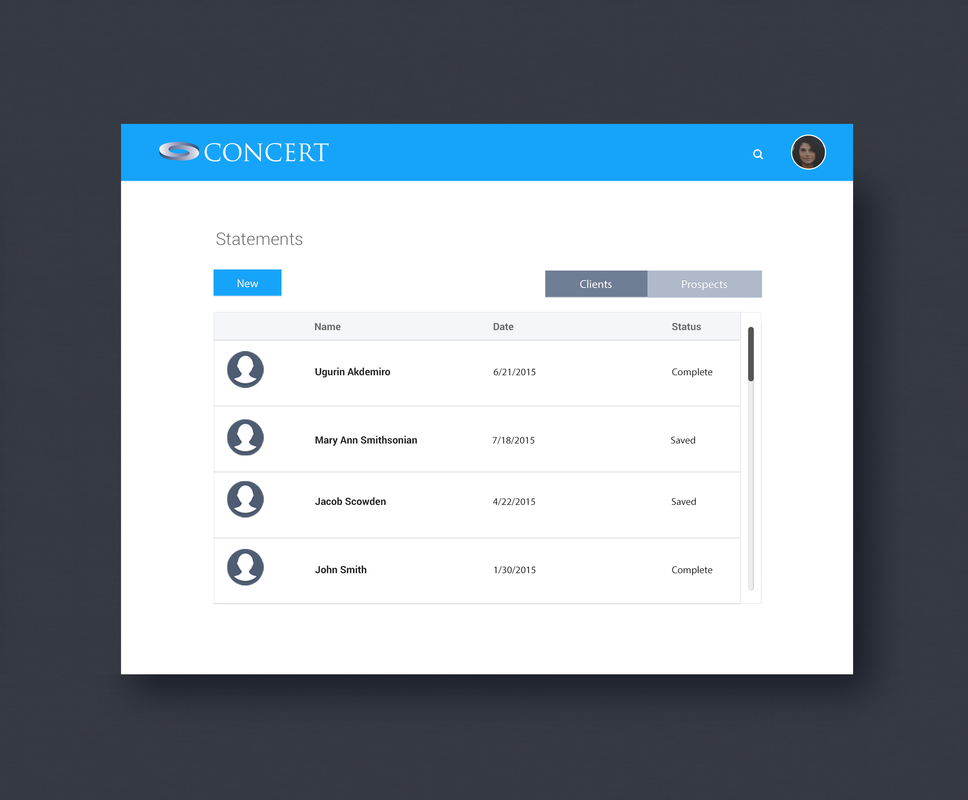

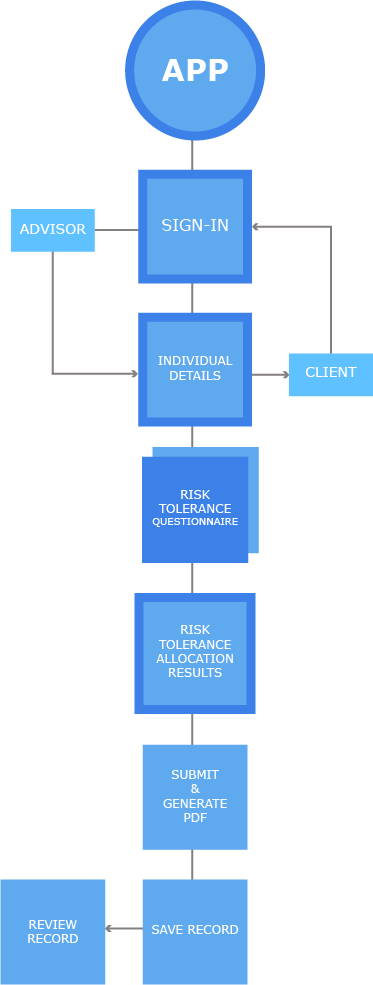

The IPS was used during the advisor-client meetings and ongoing portfolio reviews.

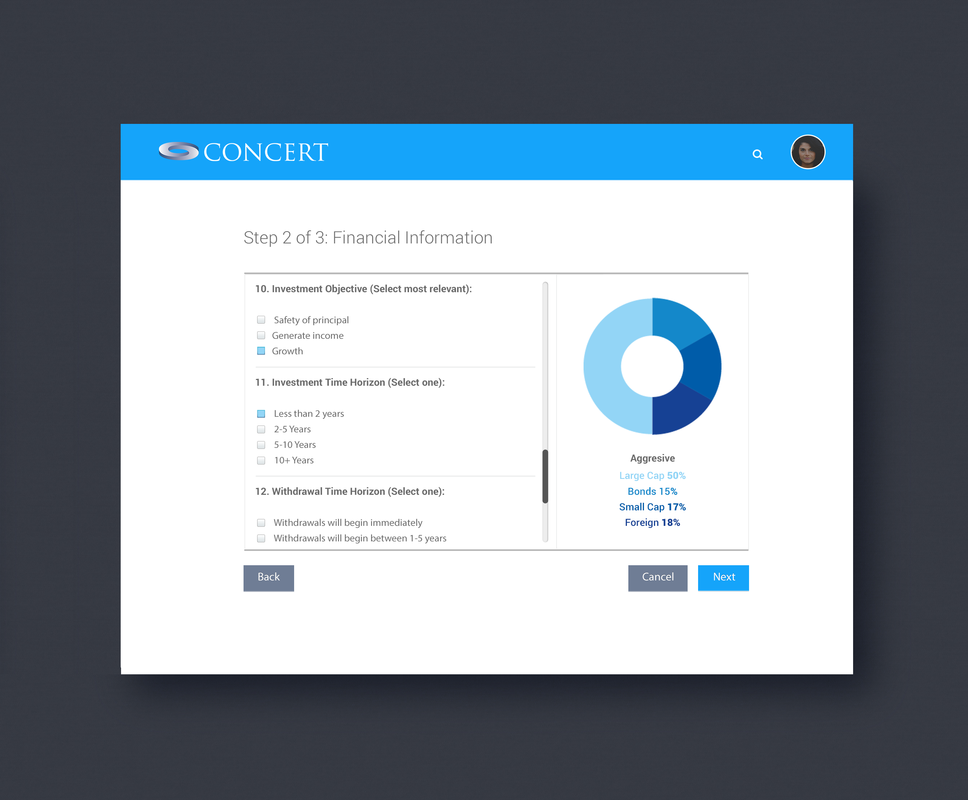

The app started with a series of personal and investment questions that the client answered.

The IPS computed the results related to the answers provided.

Interactive tools for the investment profile helped advisors and clients change variables in real time. This allowed them to review the investment risks/return options easily.

Users moved backwards or forward through the app to add, update or change information.

Users reviewed the final answers before submitting the data.

After submitting the information a PDF was generated. Advisors printed and emailed the IPS file to the client and stored it securely online.

Advisors reviewed current IPS's before or during meetings with their clients and while managing their portfolios. They could compare previous versions and goals set by clients.

Advisors used a dashboard with the IPS's of all their clients and prospects.

An extra functionality included the ability to send the client a personalized IPS link so he/she could fill on its own. In this case, the advisor would receive an email with the confirmation that the IPS was complete. This saved time and prepared the advisors better for follow up meetings.

Interactive Graphs

Advisor Flow.

Solution

The IPS app was released online, used by advisors:

Developed a solid Investment Policy Statement app applying my knowledge about the financial industry and technology

Created an engaging dashboard with instant feedback about the impact on adjusting variables.

Made it easier for advisors to create a compelling financial plans for every client and prospect.

Increased the advisor's efficiency and enabled them to add value to the planning process based on experience, knowledge and relationship.

Managed the user experience, visual, and interactive design processes.

Managed the development team to ensure timely completion of the project.

Simply and easily demonstrated the impact of risks and loss tolerance to a financial plan related to the client's confidence zone.

Made the client experience consistent and the quality of the financial plans scalable.

Included monitoring and control procedures to be followed by advisors and clients involved in the investment process.

Enabled clients to focus on long term goals and discouraging reactive behavior due to the impact of short-term market performance, early death or unexpected costs. This is because IPS changes should be based on personal financial or lifestyle changes.

The app version I developed was used via intranet and new versions have been released by other people.